✓ SubscribeSubscribers: 274

RG Analitics 🟢 [PRIVATE CHANNEL🔒]

RG Analitics 🟢 [PRIVATE CHANNEL🔒]

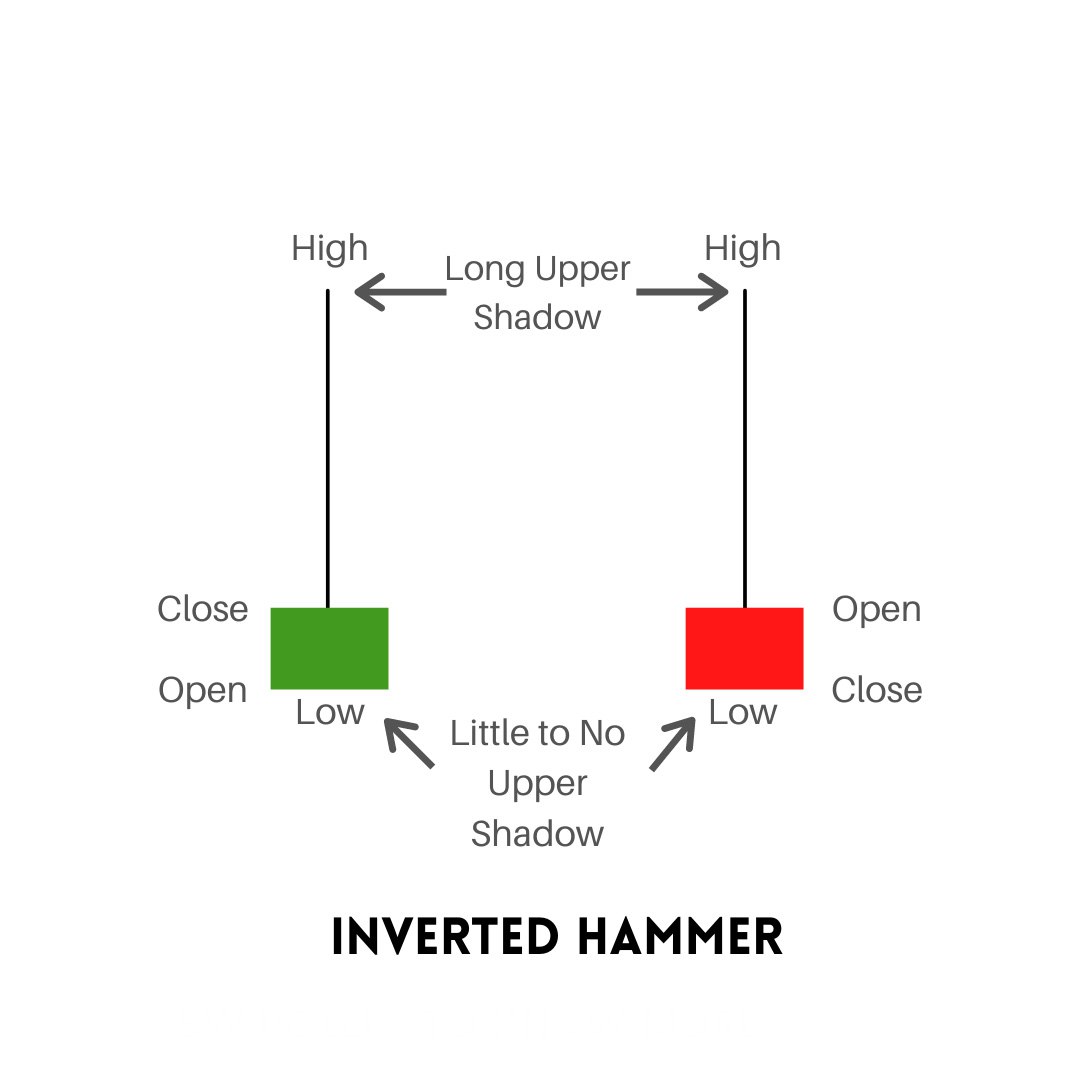

What is Inverted Hammer Candlestick ?

The #inverted hammer is a type of candlestick pattern found after a downtrend and is usually taken to be a trend-reversal signal. This creates a #long shadow or wick on the upper end of the candlestick and a small body at the bottom.

The Inverted Hammer is seen as a #bullish reversal pattern, meaning that it suggests a potential change in the direction of the price trend from downward to upward. This is because the long lower wick shows that the #market attempted to push the price down, but was ultimately unsuccessful, and the #buyers stepped in to drive the price back up.

#Traders often look for confirmation of a bullish reversal by observing price action in the following periods. If the price continues to rise, it can indicate a reversal is underway. However, if the price drops below the low of the #Inverted Hammer in subsequent periods, this may invalidate the bullish reversal signal.

The #inverted hammer is a type of candlestick pattern found after a downtrend and is usually taken to be a trend-reversal signal. This creates a #long shadow or wick on the upper end of the candlestick and a small body at the bottom.

The Inverted Hammer is seen as a #bullish reversal pattern, meaning that it suggests a potential change in the direction of the price trend from downward to upward. This is because the long lower wick shows that the #market attempted to push the price down, but was ultimately unsuccessful, and the #buyers stepped in to drive the price back up.

#Traders often look for confirmation of a bullish reversal by observing price action in the following periods. If the price continues to rise, it can indicate a reversal is underway. However, if the price drops below the low of the #Inverted Hammer in subsequent periods, this may invalidate the bullish reversal signal.